The mouse cursor hangs there, a flickering white dagger over the ‘Complete Purchase’ button. It’s been there for thirteen minutes. The total in the cart is $453. Not for a new GPU, not for an ASIC, not for anything that actually computes a hash. This is a cart filled with the peripheries of the periphery: braided PSU extension cables in a specific shade of grey, three sets of custom-molded silicone fan grommets promising a 3-decibel noise reduction, a laser-cut acrylic shroud to redirect airflow by a theoretical 13 degrees, and a digital power meter that syncs to a cloud service I will forget about in 33 days. My thumb aches from scrolling, from clicking, from weighing the infinitesimal gains against the very tangible cost. This isn’t an investment calculation. It’s a diagnosis of a condition.

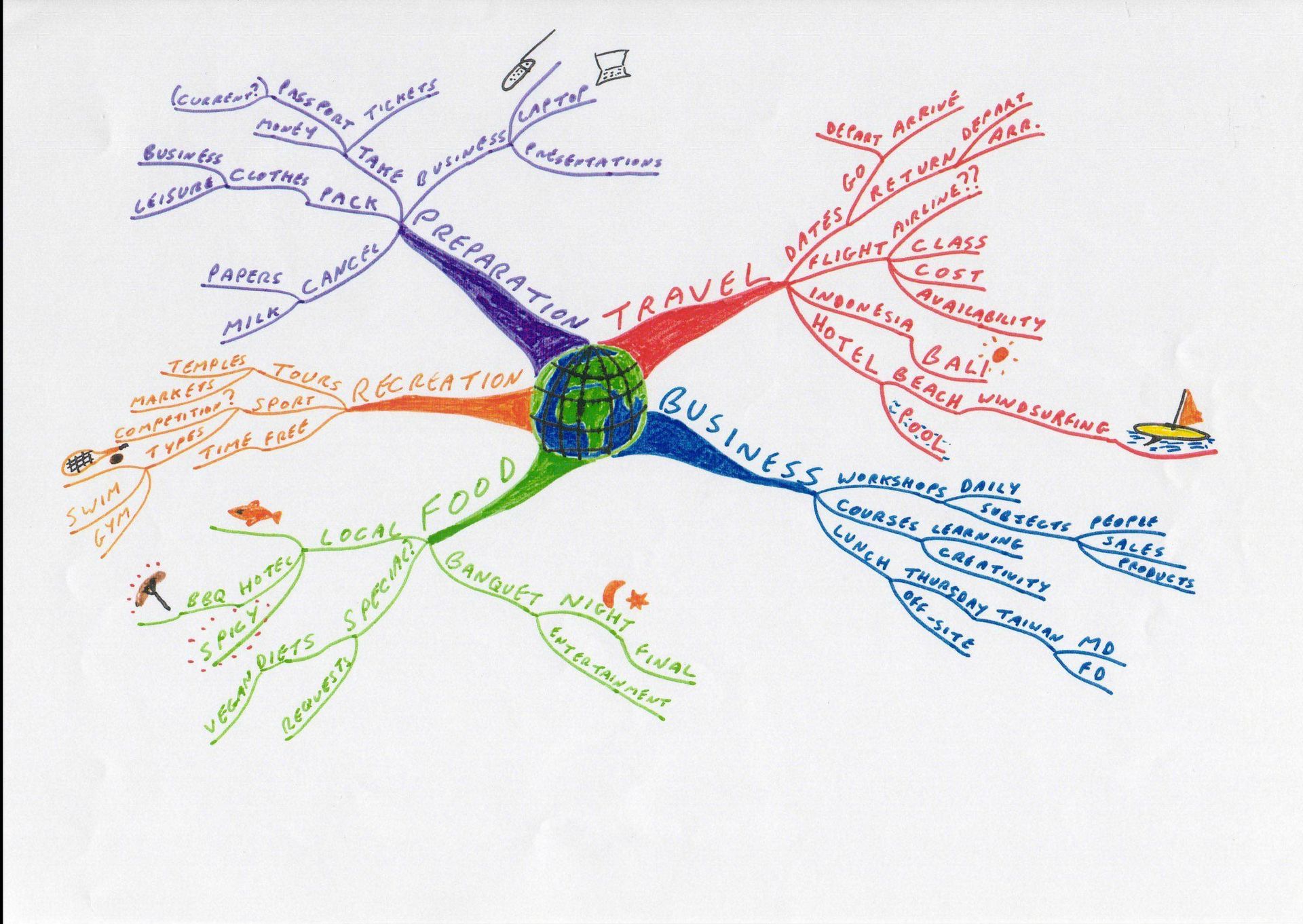

The Treadmill of the “Final 2%”

The big lie they don’t tell you when you first get into mining is that the hardware is the final step. You buy the box, you plug it in, you profit. The reality is that the hardware is just the admission ticket. The real show, the one that can drain your wallet and your sanity, is the endless quest to optimize the final 2%. It’s a universe of small, expensive objects, each one whispering a promise of ‘better.’ A little cooler, a little quieter, a little